Revealing the Opportunity: Can People Discharged From Bankruptcy Acquire Credit Cards?

Understanding the Impact of Personal Bankruptcy

Upon declare personal bankruptcy, individuals are challenged with the significant repercussions that permeate numerous elements of their financial lives. Bankruptcy can have a profound effect on one's credit rating, making it testing to accessibility credit history or loans in the future. This financial stain can linger on credit rating reports for a number of years, influencing the individual's ability to secure desirable rate of interest rates or financial possibilities. Furthermore, insolvency might lead to the loss of possessions, as specific ownerships might need to be liquidated to pay back financial institutions. The psychological toll of bankruptcy ought to not be underestimated, as individuals may experience feelings of guilt, stress and anxiety, and shame due to their financial circumstance.

In addition, personal bankruptcy can restrict work chances, as some companies perform credit history checks as part of the employing procedure. This can present a barrier to people seeking new work prospects or occupation developments. On the whole, the impact of insolvency expands beyond financial restraints, affecting numerous elements of an individual's life.

Elements Impacting Bank Card Approval

Getting a charge card post-bankruptcy rests upon numerous key elements that significantly affect the authorization procedure. One crucial element is the applicant's credit rating. Complying with personal bankruptcy, people frequently have a low credit rating because of the adverse impact of the bankruptcy declaring. Bank card firms generally seek a credit report that shows the candidate's capability to manage credit scores responsibly. An additional vital consideration is the candidate's earnings. A stable revenue guarantees credit scores card issuers of the person's ability to make timely repayments. Additionally, the length of time because the bankruptcy discharge plays an essential duty. The longer the period post-discharge, the extra desirable the possibilities of authorization, as it suggests economic security and responsible credit report habits post-bankruptcy. In addition, the type of bank card being requested and the issuer's particular requirements can additionally affect approval. By carefully thinking about these factors and taking actions to restore credit rating post-bankruptcy, people can improve their leads of obtaining a bank card and working in the direction of monetary healing.

Actions to Reconstruct Credit Score After Personal Bankruptcy

Restoring credit history after insolvency needs a tactical approach focused on financial discipline and regular debt administration. One reliable method is to get a secured credit card, where you transfer a particular amount as security to establish a credit score restriction. Additionally, take into consideration coming to be an authorized individual on a family members member's credit report card try this site or checking out credit-builder loans to further improve your credit scores rating.

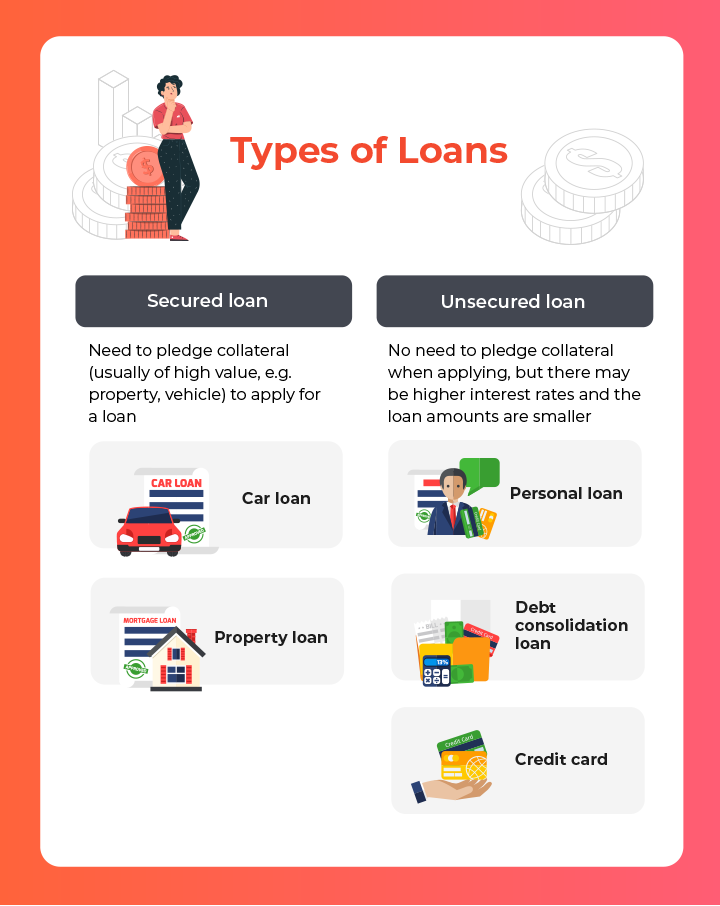

Protected Vs. Unsecured Debt Cards

Adhering to personal bankruptcy, individuals frequently consider the selection in between protected and unsafe credit cards as they intend to rebuild site web their credit reliability and financial security. Guaranteed credit cards call for a cash down payment that serves as security, normally equal to the credit history limit approved. Inevitably, the option between safeguarded and unprotected credit scores cards must straighten with the individual's financial goals and ability to handle credit history sensibly.

Resources for Individuals Looking For Credit Score Rebuilding

For people aiming to enhance their credit reliability post-bankruptcy, checking out readily available resources is critical to effectively navigating the credit rating restoring process. secured credit card singapore. One beneficial resource for people looking for debt rebuilding is credit score therapy agencies. These companies supply monetary education, budgeting support, and individualized credit rating renovation strategies. By functioning with a credit score therapist, individuals can acquire insights into their credit rating reports, discover methods to enhance their credit rating, and receive guidance on managing their finances effectively.

Another useful resource is credit history monitoring solutions. These solutions allow individuals to maintain a close eye on their credit history reports, track any mistakes or changes, and detect potential indicators of identification burglary. By monitoring their credit routinely, individuals can proactively address any kind of concerns that might ensure and emerge that their credit score information depends on day and exact.

Additionally, online tools and resources such as credit rating simulators, budgeting apps, and monetary proficiency websites can offer individuals with valuable info and devices to aid them view publisher site in their credit rebuilding trip. secured credit card singapore. By leveraging these sources efficiently, individuals released from insolvency can take significant steps in the direction of enhancing their credit report health and safeguarding a better monetary future

Verdict

In verdict, people discharged from personal bankruptcy may have the chance to obtain credit cards by taking steps to rebuild their credit scores. Variables such as credit rating debt-to-income, history, and earnings ratio play a substantial duty in charge card authorization. By comprehending the effect of insolvency, picking in between safeguarded and unsecured charge card, and utilizing resources for debt restoring, individuals can improve their creditworthiness and potentially get access to credit report cards.

By functioning with a debt therapist, individuals can gain insights right into their credit records, find out techniques to enhance their credit report ratings, and receive guidance on managing their financial resources properly. - secured credit card singapore

Comments on “What You Need to Know Before Looking For a Secured Credit Card Singapore”